What you have paid for the option in the beginning.What you can get when exercising the option.Put Option Payoff FormulaĪs you can see from the examples above, a long put option trade’s total profit or loss depends on two things: Therefore total P/L is actually a loss equal to the initial cost of the option ($245 in this example). Above the strike, the put option has zero value, because there is no point exercising the right to sell the underlying at strike price when you can sell it for a higher price without the option. The payoff function changes where underlying price equals the option’s strike price (40 in this example). Underlying price is equal to or higher than strike price With initial cost of $245, total result of the trade is 385 – 245 = $140 profit. You can immediately buy it back on the market for 36.15, realizing a profit of 40 – 36.15 = 3.85 per share, or $385 per option contract. In this case, with 1 contract representing 100 shares, the profit increases by $100 for every $1 decrease in underlying price.įor example, if underlying price is 36.15, you can exercise the put option and sell the underlying security at the strike price (40.00).

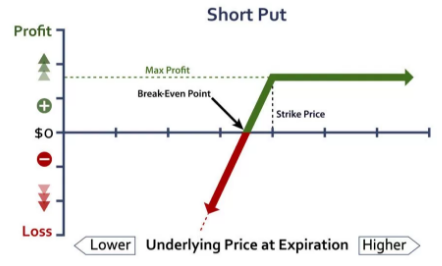

The relationships is linear and the slope depends on position size. Underlying price is lower than strike priceĪs you can see in the diagram, a long put option’s payoff is in the positive territory on the left side of the chart and the total profit increases as the underlying price goes down. Put Option Scenarios and Profit or Loss 1. Of course, it also depends on your position size (1 contract representing 100 shares in this example). It shows a long put option position’s profit or loss at expiration (Y-axis) as a function of underlying price (X-axis).īesides underlying price, the payoff depends on the option’s strike price (40 in this particular example) and the initial price at which you have bought the option (2.45 per share in this example). Note: If you are a bit lost in the long/short/bullish/bearish terminology, see Call, Put, Long, Short, Bull, Bear… Confused? Put Option Payoff Diagram A long put option position is therefore a bearish trade – makes money when underlying price goes down and loses when it goes up. When holding a put option, you want the underlying price go down, because the lower it gets relative to the strike price, the more valuable your put option becomes. While a call option gives you the right to buy the underlying security, a put option represents the right (but not obligation) to sell the underlying at the given strike price. If you have seen the page explaining call option payoff, you will find the overall logic is very similar with puts there are just a few differences which we will point out. Calculation of a put option position’s break-even point (the exact price where it starts to be profitable).Calculation of put option payoff in Excel.Exact formulas to calculate put option payoff.All the things that can happen with a long put option position, and your profit or loss under each scenario.Drawing Option Payoff Diagrams in Excel.Call, Put, Long, Short, Bull, Bear: Terminology of Option Positions.

0 kommentar(er)

0 kommentar(er)